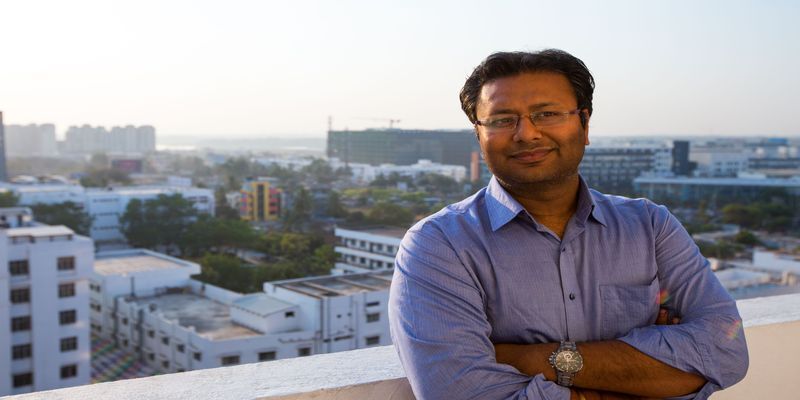

How SmartCoin is using deep tech models to improve credit access for India’s lower income groups

28 March 2019 2:00 AM IST

SmartCoin, a three-year-old lending startup from Bengaluru, offers instant, mobile-based loans to millions of Indians without formal access to credit. Selected by Google Launchpad Accelerator earlier this year, it aims to quadruple its customer base in the next two years.

0

Next Story