India and Sri Lanka Forge Financial Tech Partnership and Debt Restructuring Deal

India and Sri Lanka advance financial technology and debt restructuring, with the early launch of Unified Payments Interface in Sri Lanka and India's support for debt restructuring process.

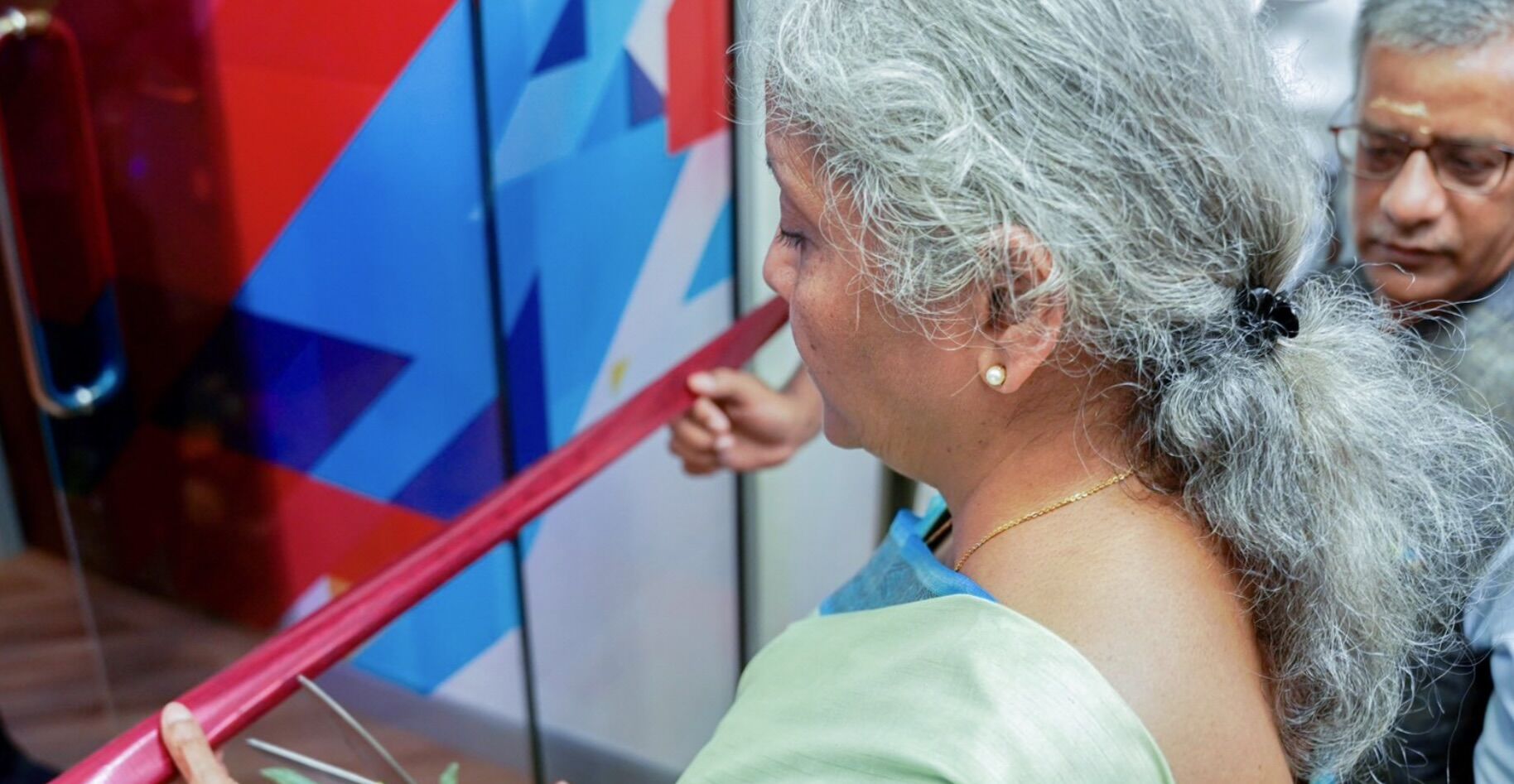

India and Sri Lanka are moving forward with discussions on advancing financial technology and restructuring debt. The recent meeting between the High Commissioner of India Santosh Jha and the Governor of the Central Bank of Sri Lanka (CBSL), Dr Nandalal Weerasinghe, highlighted the early launch of the Unified Payments Interface (UPI) in Sri Lanka, which was originally agreed upon in July 2023. This collaboration comes as India continues to show support for Sri Lanka's debt restructuring process, providing over USD 4 billion in assistance, exceeding the International Monetary Fund's support of USD 3 billion.

The development of UPI and the efforts to connect with the Lanka Pay system demonstrates the commitment to strengthening financial ties between the two nations. As Sri Lanka continues to secure agreements from external creditors for debt restructuring, it sets the stage for the IMF to review the USD 2.4 billion bailout facility approved earlier. This collaboration marks a significant milestone in the 75th year of diplomatic relations between India and Sri Lanka, as they work together to promote economic recovery and stability in the region.